Mining the cryptocurrency craze as rigs sprout across Singapore

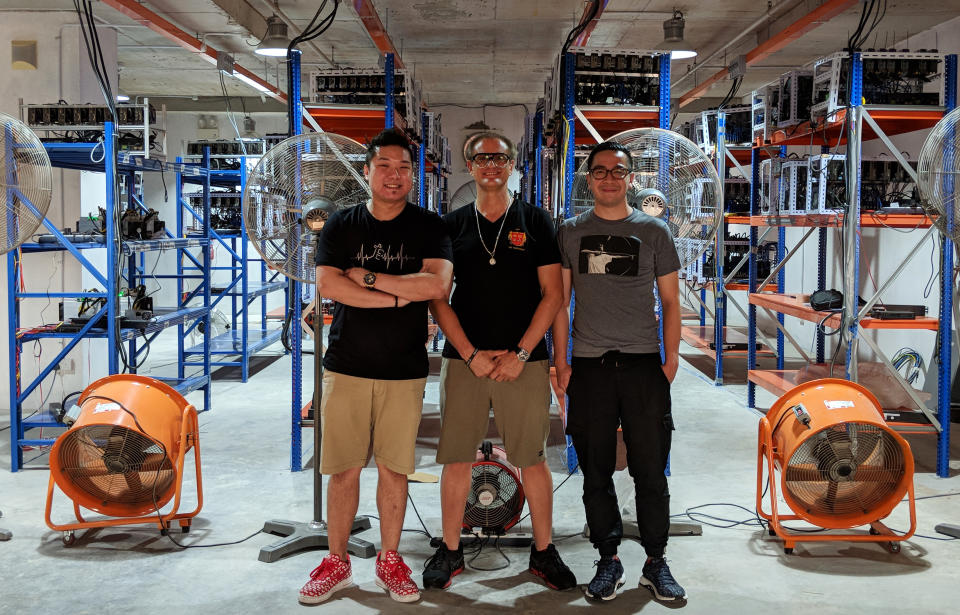

With the digital currency fever taking Singapore by storm, companies that host computing “mining rigs” have been popping up over the island, some even as recent as last month.

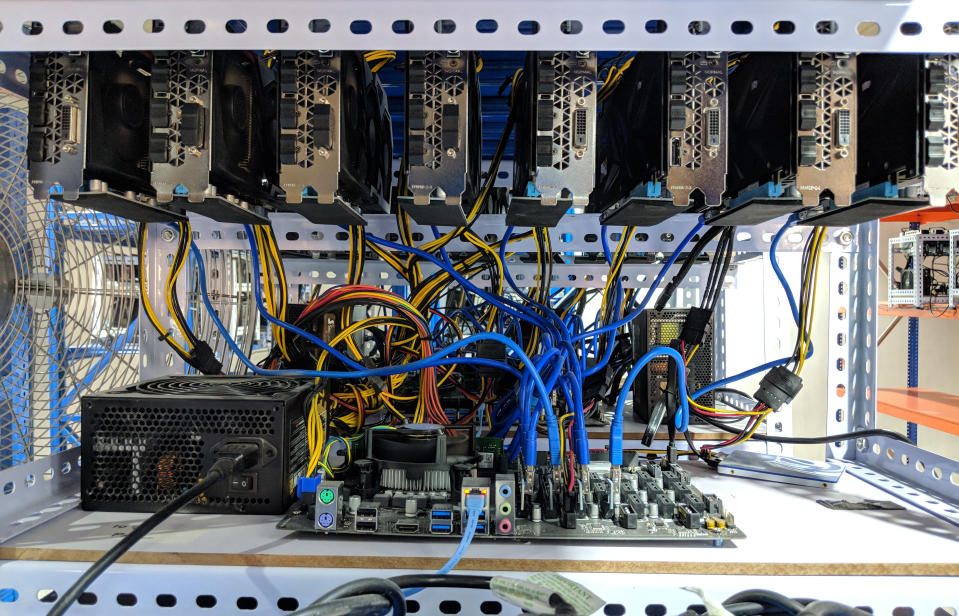

Mining rigs – fashioned out of various gaming computing components – solve complex mathematical problems to obtain cryptocurrencies like Ethereum and Bitcoin.

To run these, however, require space, and more importantly, immense electricity supply.

As such, many rig owners or “miners” have turned to renting industrial spaces shared privately between a few friends, or relying on “hosting” companies that manage mining “farms”.

“Hosting” companies charge a monthly “rental” fee – typically paid in six-month to one-year contracts – for storing, running their customers’ rigs along with often around-the-clock maintenance and support.

Mining.SG chief technology officer Dexter Ng quipped, “Now the (Singapore) market has a lot of people who own rigs. At the same time, a lot of customers complain that there are no place to put them at home.”

The company has sold over 1,000 ready-made mining rigs, ranging from $3,499 to $9,349 each, since it started in August last year. Last month, it branched out to providing hosting services for such rigs.

Ng, an IT graduate from Republic Polytechnic, himself started dabbling in rig-making as a hobby in January last year. The 30-year-old then kept six rigs running in the five-room HDB flat where he lives with his parents and two sisters. A seventh rig that he set up even tripped the entire house.

Due to the huge electricity consumption, the heat generated by the rigs at home was unbearable.

“The house was hot, just like a kitchen when someone’s cooking. My parents were complaining about the heat,” said Ng. His electricity bill also tripled to $900, up from the usual $300 per month.

With three friends, he later rented a space for $2,000 a month to run 12 to 15 rigs.

His own experience, along with the increasing demand in the market, spurred him and his business partners late last year to take a serious look at providing customers with rig hosting options.

Having shifted into a new 14,000sqf space at Tuas Bay Drive early March as part of its expansion plans, Mining.SG now has the capacity to hold 1,300 rigs, up from 40 at its headquarters. Hosting rates vary from $199 to $219 per month, depending on the rig’s configuration – the more powerful the computing specifications, the more energy is required to run the rig. To date, they have hosted 150 rigs.

Selling and hosting thousands of rigs

Mining Rig Club CEO and co-founder Leon Lim was inspired by his own negative experience with rig-buying and cryptocurrency mining to enter the business.

The 29-year-old self-professed “geek” – and Business Administration graduate from National University of Singapore – had blown about $40,000 on six rigs that were of shoddy computing quality; only one remained functional less than a year on.

In November last year, Lim decided to start up Mining Rig Club. The firm, like Mining.SG, sells ready-made rigs – restricted to one model per “batch” – and hosts them.

“We did not want to come to a point where friends and family members say mining in Singapore is a scam. We also conduct free masterclasses every other week to educate people on what to look out for in building rigs,” said Lim. “Although we don’t make money from it, at least people can sleep better at night.”

Six months and three batches on, the company has sold “thousands of” rigs and has a total capacity to host 12,000 of them across locations in Singapore, Kazakhstan – “a war bunker” in the middle of nowhere – and Georgia. The company is currently in talks to work with partners in Norway and Ontario, Canada.

Its space at Tai Seng Drive alone has a capacity of 4,000 rigs, where over one eighth of the slots have been taken up while 6,000 rigs are hosted in Kazakhstan and Georgia. Monthly rates across the different countries range from $160 to $249 per rig, with a rig’s life span depending on the environment.

“You can save $20 to $50 a month hosting the rig in a not-so-good environment, but it lasts one to three years instead of it lasting three to five years (in a better environment),” Lim added.

Based on Lim’s own estimates, it takes a customer 10 to 18 months to break even for a $7,200 rig.

About half of Lim’s clients are based in Singapore. For Ng, about 30 per cent of his clients hail from countries like Saudi Arabia, Malaysia and Dubai, while the rest are based in Singapore.

The bulk of their customers mine Ethereum, the second largest cryptocurrency by market capitalisation, and they run the gamut from tertiary students, working adults to semi-retired businessmen.

“Our youngest customer was a 13-year-old who came with his father, and brought the rig home,” said Ng.

Another interviewee, an owner of a rig mining business who only wanted to be known as En, observed that smaller companies – those that host less than 100 rigs – “started appearing around June last year”. Chinese companies began coming to Singapore after stricter regulations were imposed on cryptocurrency trading in China in November, the 29-year-old said.

The regulatory approach to rig mining

The business of cryptocurrencies is still shrouded in regulatory fog around the world with many authorities urging investors to be cautious.

The Monetary Authority of Singapore itself had in December advised the public “to act with extreme caution” and “understand the significant risks they take on if they choose to invest in cryptocurrencies”.

Nonetheless, the local authorities have allowed both foreign and local rig miners to operate here.

According to En, apart from Mining.SG and Mining Rig Club, there are at least three big companies with rig “farms” hosting more than 400 rigs each in Singapore. Two of them are from China while the other one is from Indonesia – these bigger companies “typically keep their locations a secret and have a showroom for clients to visit”.

“Singapore is one of the more crypto-friendly countries; the general sentiment is that Singapore (authorities) are waiting it out rather than making the first move,” he said. “While it is expensive to mine in Singapore due to rental and power cost, the stability of our internet and security are large pull factors.”

According to a Bloomberg report in January, at least five shops in Sim Lim Square have also jumped on the cryptocurrency bandwagon to sell rigs.

There are no statistics available on companies that hosts rigs in Singapore as they are currently broadly classified under Singapore Standard Industrial Classification, or SSIC, as data centres. Similarly, businesses that sell ready-made rigs are broadly classified under wholesale or retail sale of computer hardware and peripheral equipment (except cybersecurity related hardware and peripheral equipment).

“We are presently monitoring such activities (among others) and will incorporate the activities into the SSIC where appropriate,” said the Singapore Department of Statistics.

Both Ng and Lim remain positive about the ubiquitousness of cryptocurrency in Singapore over the next few years.

“(Cryptocurrency trading in) Singapore is starting to pick up. One customer said he will pay for their children’s overseas university education with 10 rigs,” said Lim. “Another 71-year-old male customer said to us, ‘If I die, can I pass the wallet to the grandson?’”

Related stories:

Computer shops embrace lucrative business – outfitting cryptocurrency miners

COMMENT: The key investment and regulatory issues for cryptocurrencies

Singapore issues cryptocurrency warning

Singapore court dismisses summary judgment application in cryptocurrency suit