Kroger vs. Target: Which Retailer Is a Better Buy?

When thinking of retailers within the market, two companies – The Kroger Co. KR and Target TGT – come to mind in many situations. Of course, the two aren’t the only big names within the retail sector, but they have established themselves as two powerful forces in the arena.

With both companies operating within the same realm, it can be difficult to differentiate which company currently looks like a better investment – and that’s what we’re here to look at today. We can compare forecasted growth rates, current valuation levels, and previous quarterly results to get a more precise answer to this question.

Before that, however, let’s pivot to a quick macroeconomic backdrop.

Retail Sales

The retail sales report measures the amount of consumer spending at stores, restaurants, and online. The information is released monthly, and it’s a critical macroeconomic metric that helps investors gauge the economy’s current health and inflationary pressures that are prevalent.

Considering that consumer spending accounts for two-thirds of GDP, we can see this data’s importance.

To a bit of a surprise, the April retail sales report we received in May showed us that U.S. retail sales grew 0.9% in April, marking the fourth straight month of higher spending – all while inflation remains sky-high.

The takeaway here is that retail companies have still experienced robust demand in the face of inflation, which bodes well for the top line of these companies. However, the bottom line is where the pain has been felt – higher product and labor costs have significantly compressed margins.

Additionally, high consumer demand gives the Fed the go-ahead to keep cranking borrowing rates – the Fed has already been vocal about its plan to increase rates to tame inflation.

Now, let’s determine which retailer – Target or Kroger – looks like a better bet within the retail realm.

Target

Target TGT has evolved from primarily a brick-and-mortar retailer to an omnichannel entity. Year-to-date, Target shares are down nearly 33% and have vastly underperformed the general market. Following its latest quarterly report, shares were sent down the drain.

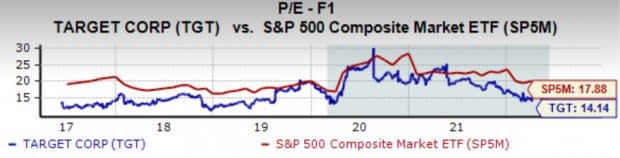

Image Source: Zacks Investment Research

TGT sports an attractive forward earnings multiple of 14.1X, well below 2020 highs of 30.4X, and sitting nicely below its five-year median of 16.3X. Additionally, shares trade at a steep 21% discount relative to the S&P 500’s forward P/E ratio of 17.9X.

Target has a Style Score of an A for Value.

Image Source: Zacks Investment Research

In its latest quarter, Target reported EPS of $2.19, which missed the Zacks Consensus EPS Estimate of $3.00 by a hefty 27%. However, this has been the only earnings miss out of the company’s last ten quarterly reports.

Analysts have been dialing back their earnings estimates across the board over the last 60 days, a reflection of the margin compression that the company has been undergoing. For FY23, the bottom line is forecasted to shrink by 18% - undoubtedly a red flag. However, the earnings picture turns positive in FY24; the $13.83 per share earnings estimate reflects a sizable 25% growth in earnings year-over-year.

For investors with an appetite for income, Target has that covered with its 2.3% annual dividend yield with a payout ratio sitting at 30% of earnings. TGT has increased its dividend five times over the last five years, undoubtedly to the likes of investors, and has a five-year annualized dividend growth rate sitting at 6.1%.

Image Source: Zacks Investment Research

Target is a Zacks Rank #3 (Hold).

The Kroger Co.

The Kroger Co. KR is an American retail company that operates supermarkets and multi-department stores throughout the U.S. Year-to-date, KR shares have been hot, increasing nearly 13% in value and easily crushing the S&P 500’s return. The substantial share performance amidst a challenging macroeconomic backdrop speaks volumes about the company’s health.

Image Source: Zacks Investment Research

Kroger boasts a 13.4X forward earnings multiple, well below highs of 16.4X earlier this year. Additionally, the value represents a deep 25% discount relative to the S&P 500’s value.

Kroger has a Style Score of an A for Value.

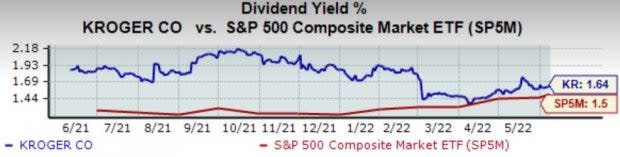

Image Source: Zacks Investment Research

KR has been on a blazing-hot earnings streak, chaining together nine consecutive EPS beats dating back to early 2020. Over its last four quarterly reports, KR has exceeded bottom line estimates by an average of 22%, and in its latest quarter, the retailer beat earnings expectations by a substantial 25%.

Analysts have primarily been raising their earnings outlook over the last 60 days, with the upcoming quarterly EPS estimate of $1.27 reflecting a respectable 6.8% expansion in the bottom line from the year-ago quarter. Additionally, for the current fiscal year, earnings are expected to grow 4.4%, and in FY24, the bottom line is forecasted to expand an additional 3.9%.

Kroger enjoys rewarding its shareholders via its 1.6% dividend yield with a payout ratio sitting sustainably at 23% of earnings. The company has increased its dividend five times over the last five years, with a five-year annualized dividend growth rate of a spectacular 12.7%.

Image Source: Zacks Investment Research

Kroger is a Zacks Rank #2 (Buy).

Decision Time

High labor and product costs have both played spoilsport for these companies’ bottom line results. In addition, supply chains are entirely out of equilibrium, further compressing margins.

When comparing the two, however, I think that there’s a clear winner, and it’s Kroger.

Here’s why – the company’s share performance throughout a brutal 2022 has been stellar, quarterly results have remained strong amidst a challenging macroeconomic backdrop, positive estimate revisions have been nearly across the board, and KR has more attractive valuation levels.

Lastly, and most importantly, Kroger sports a higher Zacks Rank than Target does, further instilling confidence in share appreciation moving forward.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Target Corporation (TGT) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance